An industry first: the digital customer experience reimagined

As the world’s first white-labelled trade finance portal as-a-service for Banks, Galileo TPaaS for Banks, helps financial institutions enable digital trade services for their clients on a portal tailored with their own logo and branding.

Galileo TPaaS for Banks is the fastest and most secure way to revolutionise customer experience.

The world’s first white-labelled Trade Finance portal-as-a-Service

An accelerated and innovative approach to trade

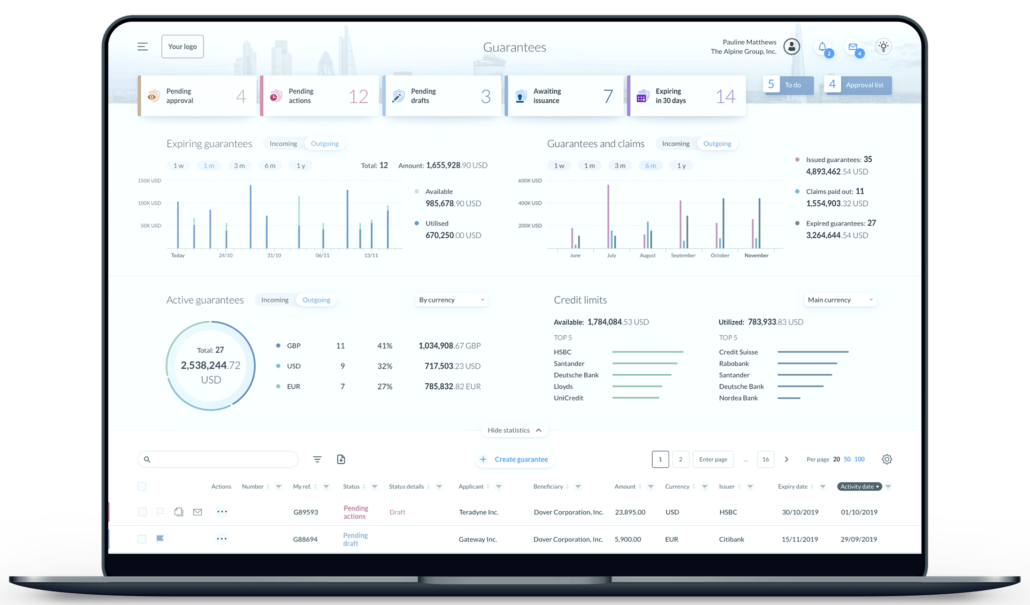

Galileo TPaaS for Banks offers a transformed user experience that is simple, intuitive, and designed to give your customers greater autonomy in management of their trade transactions.

Built on modern technology, Galileo TPaaS for Banks delivers an enhanced user experience, unrivalled functionality, and a broad suite of connectivity options for banks. It is available on demand as a fully managed service on the cloud.

- Galileo TPaaS for Banks offers the fastest and most cost-effective way to revolutionise your customer experience.

- The solution comes branded with your logo and colour palette.

- Banks can deliver a quick digital experience for customers in developing markets.

Ready connectivity with carriers. Galileo TPaaS for Banks gives your clients access to more than 200 carriers across the globe.

Galileo TPaaS for Banks helps financial institutions achieve:

- Accelerated time to market for delivering digital Trade services to clients

- Lowered total cost of ownership in comparison to an in-house build or traditional software

- Significantly improved customer experience and deepened engagement

- Greater scope of innovation through easy integration of external services

- Freedom from technical debt and greater agility in the world of evolving technologies

- Significant reduction in client administration overheads for high-volume trade activity

- Increased customer satisfaction across small businesses, SMEs and multinationals

Powerful Bolero Platform

![]()

Browser agnostic

Multiple browser support across multiple devices including laptops, computers and tablets.

![]()

Single platform

Access all Bolero services and products in one place.

![]()

Value-added services

Add extra services to deliver greater functionalities.

![]()

Multi-layered architecture

Scalable and flexible technology stack to ensure maintainability and easy upgrades.

![]()

Flexible integration

More ways to easily integrate and connect with Bolero products.

![]()

Wider and deeper functionality

New interface comes with extended functionality on LCs, Presentations and Guarantees.

Galileo TPaaS for Banks boasts a multi-layer architecture consisting of:

Core products: Support for Trade Finance instruments such as Letters of Credit, Guarantees and Standby LCs, ePresentations under LCs and Open Account, Documentary Collections, and electronic bills of lading management.

Common modules: A set of common modules such as an informative dashboards where your customers can view all trade transactions, audit trail to view historical information, document management capabilities, charges, credit limits and reporting.

Value-added services: Banks can provide additional features to customers by tapping into Bolero’s partner network. We work with leading technology partners to embed innovative functionalities such as AI-enabled document pre-check, shipment tracking et al within Galileo TPaaS for Banks.

Integration and connectivity: Integrate with existing in-house bank systems or third-party applications using the latest API and connectivity options.

Legal & Security Framework: A safe, secure and trusted environment for all trade transactions.

![]()

Leveraging the Bolero network and enabling multi-banking capabilities

For the first time ever, financial institutions have the power to enable multi-banking capabilities on their trade portal and leverage the power of the Bolero network. Bank’s trade clients for the first time can execute transactions to all their banking partners with our easy-to-use, intuitive, and robust all-in-one Galileo TPaaS for Banks portal.

With all your client’s trade finance operations in one place, now more than ever you will be able to increase your stickiness and increase the lifetime value of your customers with abundant upsell opportunities.

- Secure and powerful, white-labelled trade finance portal as-a-service for banks to accelerate digitisation and transform customer experience.

- Enable digital trade services for your clients on a portal tailored with your own logo and branding.

- Lower the total cost of ownership in comparison to an in-house build or traditional software and accelerate the time to market for delivering digital trade services to your clients.

- As a financial institution, enable multi-banking capabilities on your trade portal and leverage the power of the Bolero network. Your trade clients for the first time can execute transactions to all their banking partners with an easy-to-use, intuitive, and robust all-in-one portal.