Anchal Tiwari, Head of Products

For more than 2 decades, Bolero has been at the forefront of Trade digitisation. We have been working with largest corporate clients, banks, and shipping companies to digitise their trade processes and identify use cases which were not previously addressed by the market. We were the first to pioneer the commercial usage of the electronic Bill of Lading and over the years we have built up immense knowledge in the trade finance space and we are fortunate to have access to valuable data and research that allows us to build incredible products that bring real value to our customers.

Last year we introduced Galileo, our new technology platform that addresses the new challenges of digital trade in a fast-moving landscape of technological innovation, and customer expectations. With Galileo, we have built a strong foundation that allows us to continually innovate and build novel solutions for banks, carriers, and corporates.

More recently, we launched our new Galileo Multi-Bank for Corporates solution built our new technology platform. With this new solution, we have created a truly open trade ecosystem that enables the convergence of physical and financial supply chain by incorporating multi-banking capability with the electronic bill of lading (eBL) solution that we pioneered.

You can read more about our work so far here.

And this year we are making the biggest leap in trade finance.

The next frontier of digital trade finance; Introducing Galileo TPaaS for Banks

Corporates globally are looking to digitise their trade processes to save time, increase visibility of their transactions, eliminate operational and courier costs, and reduce risks associated with manual processes.

Banks on the other hand have been under significant pressure to provide new and improved digital services to their corporate customers who are pushing for a fully digital experience.

We introduce the world’s first white-labelled trade finance portal-as a-service for Banks; Galileo TPaaS for Banks.

Galileo TPaaS for Banks is the fastest and most cost-effective way for banks to digitise customer experience for their trade finance clients and comes fully branded with the bank’s colour palette and logos. Built on modern technology, it delivers an enhanced user experience, unrivalled functionality, and a broad suite of connectivity options for banks.

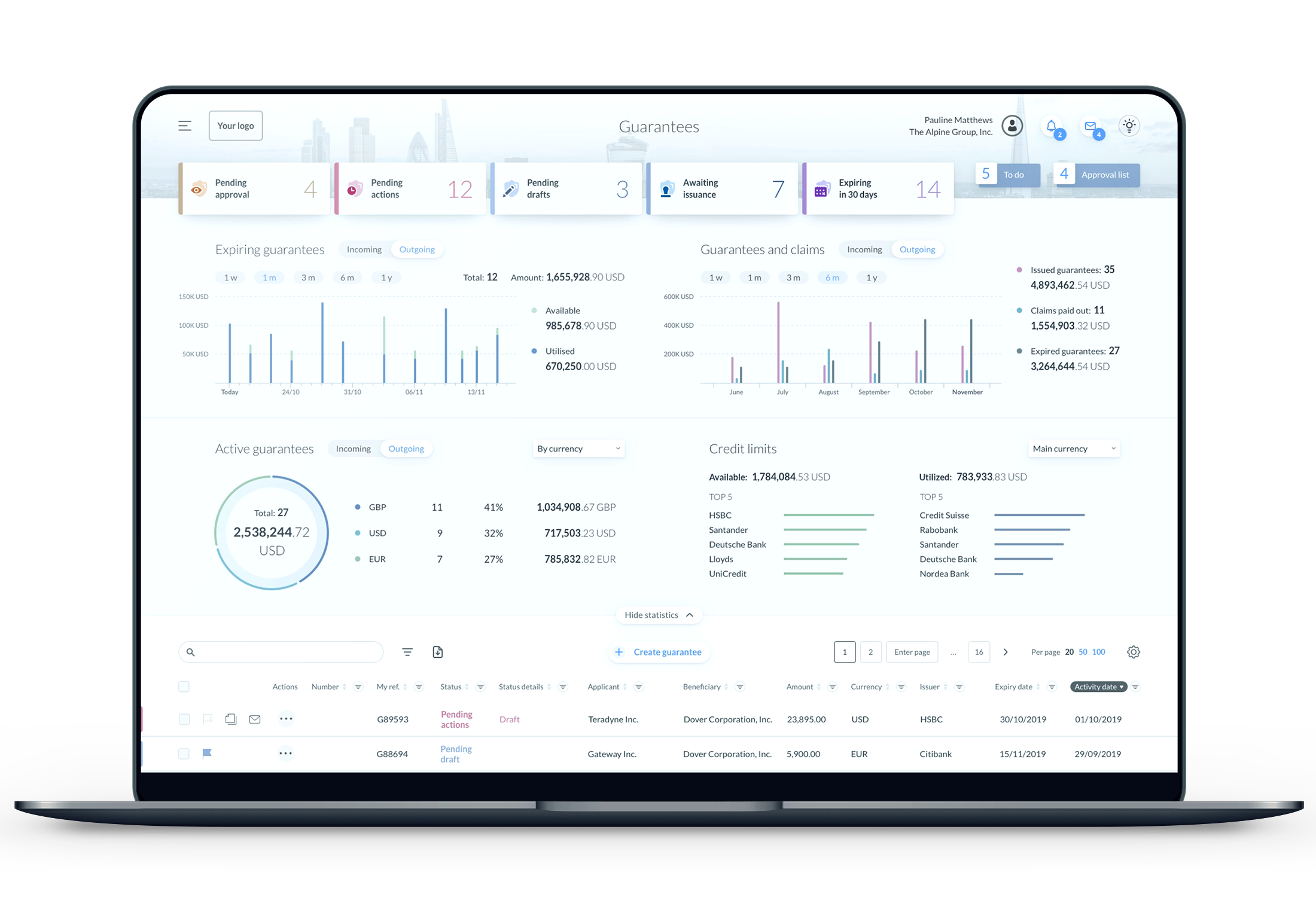

Galileo TPaaS for Banks offers a transformed user experience that is simple, intuitive, and designed to give corporate customers greater autonomy in the management of their trade transactions. It comes with market-leading features for trade finance products like Letters of credit, Guarantees/Standby LCs, document presentations under LC with more products in the pipeline.

Galileo TPaaS for Banks comes with:

- Support for all operations under LCs and Guarantees such as issuance, amendment, advising, confirmation, extend or pay, claim etc.

- Collaborative drafting of guarantees between all clients and banks.

- Presentation of documents under LCs and open account.

- Management of electronic Bill of Lading (eBL) lifecycle.

- In-built cloud storage and transmission of documents.

- Complete visibility of trade transactions and history via analytics and reports.

- Ready connectivity with over 200 carriers for getting eBLs.

Trade portal as-a-service

Galileo TPaaS for Banks is available on-demand as a fully managed service on our secure cloud.

This allows Banks to have an accelerated time to market, reduce the huge costs associated with building a bespoke portal but allow for great flexibility. The bank does not require any infrastructural changes and no requirements for separate deployment.

The commercial model is based on a simple recurring subscription fee.

With Galileo TPaaS for Banks, we can now offer a fully managed trade portal to the bank – as a service on the cloud – and banks can start using the service immediately and onboard their clients.

The bank not only receives the appropriate scaling for their customers but also cutting-edge technology with our future-proof Galileo platform, highly skilled resources, constant support and updates. The hassle of maintaining the solution is eliminated entirely.

Galileo TPaaS is designed for a quick start setup

With no integrations required to start, Galileo TPaaS for Banks at its core facilitates an accelerated time to market allowing you to get up and running in a matter of days.

Banks can choose the option suitable for them to allow for a quick start. As such, there are two available methods:

- Direct user access: this method allows bank users to receive and/or respond to client transaction requests using the Galileo bank user interface. This method does not require an any integration. This means that banks can get up and running in no time.

- Direct connectivity: this is where a bank’s back-office system can directly receive client requests using APIs or any other connectivity option the bank chooses. Galileo comes pre-integrated with the major third-party back-office applications thus shortening the implementation cycle considerably.

With flexible implementation models to choose from, banks can quickly launch digital trade services for their trade clients at lightning speeds. Banks can start with direct access and opt for integration at a later stage.

Galileo TPaaS allows for single sign-on (SSO) connectivity which means the bank’s corporate clients can access the portal from within the bank’s existing corporate channel.

With Galileo TPaaS for banks, we are empowering financial institutions to accelerate the delivery of digital trade services to their clients, whilst also reducing the total cost of ownership in comparison to an in-house build or the traditional software procurement procedures.

We worked with leading corporate clients and financial institutions and designed Galileo TPaaS to help banks to deliver digital trade services to their clients without the need of taking on a complex implementation project or make heavy technology investments towards digitization.

We are continuously adding more features on Galileo and collaborating with other innovative fintech specialists with expertise in artificial intelligence, machine learning and IoT based solutions to enhance and deepen the functionalities we offer within Galileo TPaaS for Banks. This will result in a significantly improved customer experience and Increased customer satisfaction through innovative value-added services.